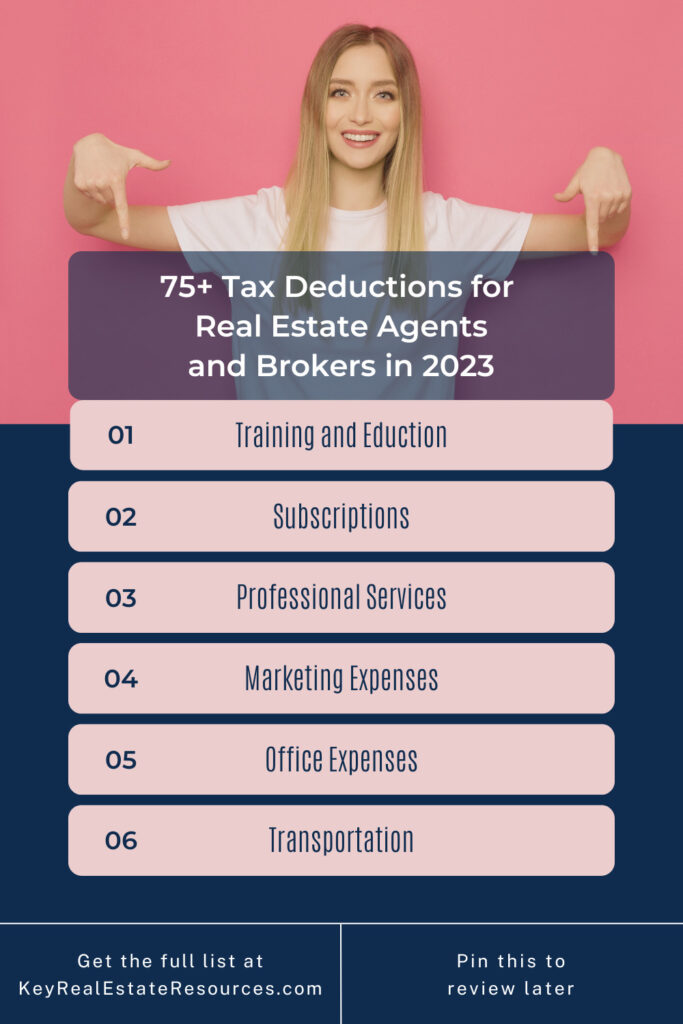

Just in time for tax season, we’re exploring 75+ tax deductions for real estate brokers!

As a real estate broker or agent, you have lots of expenses. These expenses help fuel your business, generating more leads and increasing your efficiency so you can help more buyers and sellers. And, mercifully, these expenses are tax deductible, which means that you don’t have to pay taxes on the income that goes to cover these expenses!

But not every expense is tax deductible. To qualify, expenses must be:

- Directly tied to your business,

- “Ordinary and necessary” (for example, in most markets, a boat would not be ordinary or necessary, but if you work in a community of islands, a boat might be perfectly ordinary and necessary for showing clients properties on multiple islands),

- A reasonable amount (this is subjective, but the purchase price for a new Bugatti, for example, is probably too excessive to be considered a reasonable amount), and

- Documented (you may need to show proof of payment if you’re ever audited).

In addition to these caveats, some items are excluded (like country club dues, even if you mainly use your membership for business networking). And some expenses are only partially deductible (like gifts for clients).

So let’s go through our giant list of tax deductions for real estate brokers and outline exactly which expenses you can deduct.

Quick note: Anyone with a broker’s license can be considered a real estate broker, as opposed to a real estate agent. In some states, all licensed real estate sales professionals receive broker’s licenses, so this list applies to all brokers and agents, whether you’re a supervising broker or a sales agent.

What are Tax Deductions?

Tax deductions are amounts that you can subtract from your income for tax purposes.

So, for example, if you make $100,000 this year, but you have $25,000 in deductions, you would only be taxed on $75,000 of your earnings.

Tax deductions can potentially save you big money on your income taxes. So it pays to consider all possible deductions. And that’s why we want to make sure you’re aware of these tax deductions for real estate brokers.

75+ Tax Deductions for Real Estate Brokers

With so many deductions to consider, let’s divide them into categories, shall we?

Training and Education

Whether your real estate courses are state-required or taken independently, they qualify as tax deductions for real estate brokers. And it’s not just courses; there are lots of ways agents increase their skills to better serve their clients. You can deduct:

1. Pre-license real estate courses

2. Continuing education courses

3. Private classes (including online courses)

4. Industry-specific books (check out our list of the 10 best books for successful real estate agents)

5. Seminars, conferences, and workshops

6. Coaching and training sessions

7. Industry publications

Subscriptions

Many brokers and agents use subscription services to handle daily tasks and improve workflow. You can deduct:

8. Paid Customer Relationship Managers (CRMs).

9. Accounting software (like FreshBooks)

10. Cloud storage fees

11. Design Software (like Canva Pro)

12. General office software (like the MS Office Suite and/or Adobe)

13. Digital signature software (like Docusign)

14. Website hosting (like Bluehost)

Professional Services

In addition to your professional subscriptions, you’ll likely have expenses paid to the professionals who help make your business a success. Here are several serviced-based tax deductions for real estate brokers:

15. Photographer fees (for listing photos, headshots, etc.)

16. Content writer (for your listing descriptions, real estate bio, content marketing materials, etc.)

17. Accountant fees

18. Wages for your executive assistant and/or virtual assistants

19. Transaction coordinator fees

20. Staging fees

21. Appraisor fees

22. Legal fees

23. Business insurance fees

24. Private health insurance fees

25. The fee for preparing your income taxes last year

26. Fees for your business bank accounts

27. Any commissions paid to other professionals

Marketing

To promote your listings (and yourself!), you should probably budget around 10% of your income on real estate marketing. And these marketing expenses are all tax deductible!

28. Business cards

29. Brochures, flyers, and door hangers

30. Signage

31. Website design

32. Postcards and other direct mailers

33. Social media ads

34. Any social media service you may have

35. Any other advertising (billboards, print ads, etc.)

Home Office

If you primarily work from home in a designated office that is used exclusively for work, you can deduct your home office expenses. This can be done in one of two ways: you can either:

36. Take the Simple Square Footage Deduction (using the IRS formula for calculating the amount of your deduction based on the size of your office)

OR

37. Itemize your home office expenses. Take the office square footage divided by your home’s full square footage to find out what percentage of your home is used for your office. Then apply that percentage to your home expenses, including:

- Mortgage interest and property taxes (if you own the home)

- Rent (if you rent)

- Utilities

- Repairs and maintenance

The general rule of thumb is that the simple deduction works best for office spaces under 300 square feet. But you can run both calculations to see which option results in the larger deduction for you.

Professional Office Space

If you work from a professional office building or co-working space, you can deduct any of the following expenses as applicable:

38. Office rent

39. Desk fees

40. Electricity

41. Phone and Internet

42. Maintenance

43. Insurance

Equipment and Supplies

Real estate brokers and agents can also deduct the cost of any equipment and supplies needed to run their business more efficiently. These real estate broker tax deductions include:

44. Cell phone and phone service (your deduction has to reflect the business usage, so if you use your phone for business and personal, you might only deduct 50% of the total expense.)

45. Computer and accessories (keyboard, mouse, webcam, speakers, etc)

46. Tablets

47. Traditional office equipment (printers, scanners, copiers)

48. Lockboxes

49. Office furniture and accessories

50. Stationary and postage

51. Ink and toner

52. Furniture and accessories kept on hand for staging

53. Drones as needed for aerial photos

54. All other office supplies (sticky notes, pens, notepads, binders, etc.)

Transportation

Like home office space, your transportation deductions can either be standardized based on an IRS formula or itemized.

55. Standard mileage deduction

The IRS-approved per-mile deduction (just multiply your work mileage by this rate to get your write-off amount)

OR

56. Itemized transportation expenses

- Lease costs or auto loan interest

- Maintenance

- Gas and/or electricity

- Tires and other replacement parts

If you put more than 15,000 miles on your vehicle per year, the standard deduction will likely save you more money. But it’s worth running the numbers for both methods. Whichever method you choose, you can also deduct additional transportation-related expenses:

57. Registration fees and taxes

58. Car washes

59. Tolls

60. Parking

Travel and Food

You might have expenses that fall more into the “travel” category than the “transportation” category. If you’re meeting a VIP client out-of-area, or you’re traveling to attend a professional conference, you can deduct your travel expenses plus some of your business meals, including:

61. Airfare

62. Lodging

63. Local ground transport

64. 50% of your business meal expenses

Miscellaneous

Finally, there are a few tax deductions for real estate brokers that don’t fit neatly into other categories.

65. After-tax retirement plan contributions

66. Refreshments for open houses

67. Rental property losses and depreciation (for those who invest in rental properties)

68. Closing gifts (up to $25 per gift)

69. Referral gifts (up to $25 per gift)

70. License fees

71. Real estate exam fees

72. Other licensure-related fees like finger-printing

73. MLS fees

74. Other association dues (including the National Association of REALTORS and your Chamber of Commerce)

75. Brokerage and franchise fees

76. E&O insurance premiums

Are You Taking Advantage of All Your Tax Deductions for Real Estate Brokers and Agents?

Bookmark this page as an annual reminder to make sure you don’t miss any of your available deductions. Every deduction you take reduces your income tax burden and saves you money!

Suddenly, tax season doesn’t seem so bad.