Property tax appeals are the secret weapon of real estate agents and brokers looking to better serve their clients, generate new leads, and create a recession-proof income stream for their business!

As a real estate expert with over 10 years of professional experience in the property tax industry, I can give you the inside scoop on this under-utilized strategy and show you how to make money with property tax appeals.

Before we jump into the details, we need to answer the question, why property tax appeals? Why should you invest time and energy in adding this entirely new service that, let’s face it, you’re probably not inherently interested in?

Let’s start by answering that Why. Then we’ll get to the How.

Note: This post was originally published in 2020. Here’s the new and improved version!

Why REALTORS® Should Add Property Tax Appeal Services to Their Businesses

The obvious reason to add property tax appeals to your business is to create a new income stream. Property tax appeal services can be exceptionally lucrative. Particularly if you live in a high-value market (like California and New York) or a state with high property taxes (like Texas and Illinois).

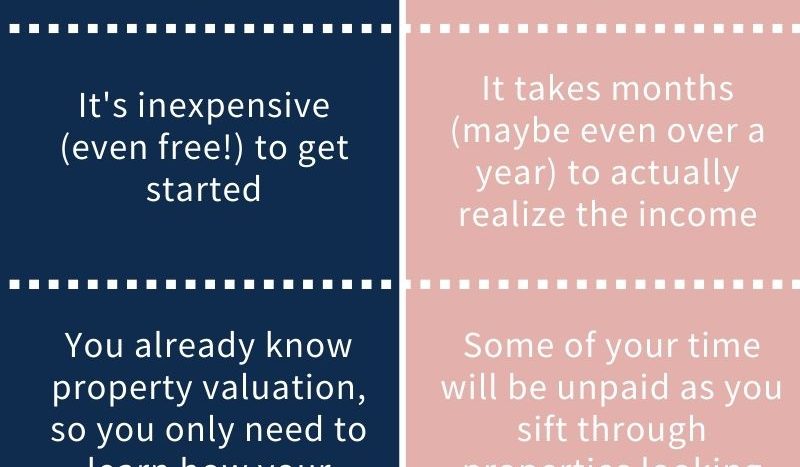

And this property tax appeal income stream is entirely unrelated to your real estate sales. So even in a down market (in fact, especially in a down market), you can generate income and grow your real estate practice. This is one of the best reasons to learn how to make money with property tax appeals! When the market is down, the appeal opportunities go through the roof (I’ll explain why in a bit). So if you add property tax appeal services to your practice, you are truly recession-proofing your real estate business. You can focus on real estate sales when the market is up and earn more money from property tax appeals when the market is down. This gives you the power to consistently grow your business under any market condition.

But income streams and recession-proofing aren’t the only reasons to start providing property tax appeal services.

You should also consider adding property tax appeal services to increase your value as a real estate professional. See, your market knowledge as a REALTOR already provides a perfect foundation for your tax appeal services. But then, once you learn how taxes are levied in your county, you’ll be able to confidently advise your future buyers and sellers on the tax implications of their real estate transactions. Can any of your competitors do that?

Plus, you can cross-sell your services to generate more buyer and seller leads. If you save a local homeowner money on their property taxes, they’ll be much more likely to hire you for their next deal.

One final reason to add property tax appeal services to your business: you already have most of the skills and knowledge required. Seriously!

You already have:

- local real estate market knowledge

- an existing client base of property owners

- an understanding of basic property valuation

- negotiation skills

- contract experience

- an entrepreneurial mindset

The only thing you currently lack is an understanding of exactly how the property tax systems work in your county. And that’s easy enough to learn on the job.

How to Make Money with Property Tax Appeals

Now that you have a compelling why (or several of them!), let’s talk about the basics of how to make money with property tax appeals.

Property taxes are usually based on the County Assessor’s estimation of the property’s value (called the “assessed value” or “assessment”). But Assessors are often wrong because they apply broad value increase formulas by sub-market (they can’t possibly value each property individually every year).

A declining housing market presents the greatest opportunity to appeal property taxes. Assessors don’t want to lower their assessments because that would mean lower-than-expected tax revenue for the government. So during a market decline, most properties will be over-assessed. And since property taxes are heavily based on the assessment, over-assessed means over-taxed.

It’s worth noting, however, that properties can be over-assessed in any market. Your county may think property values have risen 10% in your sub-market when they’ve actually only risen 5%. That gives you an opportunity to appeal those property taxes.

If you can show the county that the actual value of the property is less than the assessed value, the county will adjust the assessments. Then the homeowner will be granted a tax reduction, and you earn a commission on the reduction.

What Exactly is Involved in Property Tax Appeal Work?

All you have to do as a Property Tax Agent is show the county that the property is worth less than they think. That’s it!

So you’ll complete a Comparative Market Analysis (CMA) (very few counties require an appraisal for residential appeals) and present your valuation findings to the county taxing authority. Counties and circumstances vary, but the value presentation can often be presented via email, phone call, or video chat. If email/phone/video negotiations aren’t formal enough for your county, you’ll be invited to present your case to a hearing officer or an assessment appeals board in person.

Counties may not want to leave money on the table, but they also don’t want to over-tax their property owners. So most jurisdictions are very receptive to hearing your case for lowering the value.

Which means you want to present accurate numbers. Don’t cherry-pick the comps with the lowest price per square foot to try to trick the county into granting a reduction. They are smarter and fairer than that. They will most likely have a county employee working up their own valuation in preparation for your case, so they will catch you if you try to low-ball them.

Simply show them your honest opinion of value based on the most comparable sales, and they will almost assuredly work with you.

Why Would Homeowners Hire Me?

Are you wondering why don’t homeowners do this themselves? Well, they absolutely can! But they may not want to. The fact is, most homeowners don’t have time, don’t want to make the effort, and aren’t comfortable presenting real estate market data.

You may also wonder why homeowners wouldn’t just hire a “real” Property Tax Agent. There are also several reasons for this. Like:

- Your homeowners may not understand that they even have the opportunity to appeal their property taxes.

- Your homeowners may not know that Property Tax Representatives are a thing (did you?).

- Property tax consulting firms don’t like single-family residential appeals. There’s way more money to be made in commercial property. And since these firms don’t have real estate sales to return to when the real estate market improves, they need to make enough in the declining economy to sustain their business through an up-market. I’ve seen firms ask for as much as 50% of any tax savings as payment for SFR appeals (which is a lot when 25-35% is fairly standard in commercial appeals).

- Your former clients know you and trust you!

In my opinion, with your local market knowledge and existing relationship with homeowners, you are the best-qualified Property Tax Representative your clients could hire!

5 Keys to Really Make Money with Property Tax Appeals

Now that you understand the basics of how to make money with property tax appeals, let’s discuss the keys to making your property tax appeal service a success.

1. Make sure you’re eligible to represent your clients

Most counties don’t have any special requirements (like certifications or designations) for Property Tax Representatives (also called “Tax Agents”). But a select few may require that you register yourself as a Tax Agent in your county. There may be a fee to register, so make sure you have enough potential business to make this worth your while before paying.

Attorneys are automatically allowed to act as Property Tax Representatives in most areas, so if you happen to be an attorney, you can likely use your Bar Number and skip any Tax Agent registration requirements.

2. Be Proactive

The best time for appeal service work is in a declining housing market. But you want to work proactively to have the systems in place to make the best of that situation when it happens. So start learning now! Be prepared to offer your tax appeal services the moment the market starts declining. Even if your competition is smart enough to add a property tax appeal service once the market declines, they’ll have a lot of catching up to do if you have already reached out to affected homeowners.

But again, you may have opportunities for property tax appeals even in a strong market if your county is over-estimating the market increases, so it’s worth reviewing values for appeal opportunities in any market.

3. Market Your Services at the Right Time and in the Right Way

Don’t contact all your clients next week to tell them you’re now offering property tax services. And think twice before advertising this service on your website or social media. Because you’d probably just be making more speculation work for yourself.

Here’s how I recommend strategically tackling this new income stream:

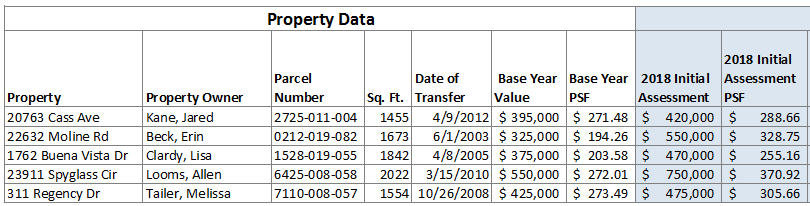

- Review the county assessments of your clients’ properties first (assessments are available online in most counties).

- Look for properties with a high assessed value per square foot for their neighborhood.

- Run a super-quick CMA for those properties to confirm that the assessed values are higher than the market values.

- Contact only the homeowners of properties that appear to be over-assessed. And only contact them just before, or during, appeal season (which varies by state and county) when property taxes may actually be on their minds.

Following these four steps in order is far more effective than simply marketing this new service to a broad audience.

Put yourself in your homeowner’s shoes. You think your taxes might be too high. You receive an email from your real estate agent saying that your taxes might be too high, and he or she can look into it for you. Nice, but not overwhelmingly compelling, right?

But what if you received an email from your real estate agent saying that he or she has already reviewed your property taxes and found that you are being over-taxed? Your agent estimates that he or she could save you about $1,500. Now you’re interested!

By doing the quick research upfront, you’re able to convert more of your property tax prospects into property tax clients.

Oh, and consider asking your colleagues if they’d like you to review their clients’ values. It’s a win-win-win. The homeowner’s taxes get reduced, you have additional opportunities to make money, and your colleagues are demonstrating their value to their clients by bringing this tax-saving opportunity to them.

4. Price Your Services Properly

When pricing your property tax appeal services, consider your brokerage agreement. Is your broker entitled to a percentage of your income? Perhaps you could negotiate a far higher percentage for yourself based on the value this would provide to the firm’s clients and the increased likelihood of referrals and repeat customers.

Having said that, there are a few different ways to price your property tax appeal services: Commission, Flat Fee, and Hourly. Let’s quickly look at each.

Commission

You’re very familiar with commission. And, in my professional opinion, this is the best structure to make money with property tax appeals.

The greatest benefit to the client is that they owe nothing upfront. It’s only once you achieve a reduction that they owe you a percentage of their savings. That makes this service an easy sell.

As I mentioned, 25-35% of the tax savings is pretty standard for commercial real estate. Most attorneys I’ve seen work SFRs charge 40-50%. The percentages can vary from property to property depending on how difficult you think it may be to achieve a reduction.

Make sure you charge enough to make this worth your while. If you can only save a client $200, and make $80, it’s probably not worth your time.

Flat Fee

There are only two scenarios in which I would recommend offering your appeal services at a flat rate:

- When you really don’t think much of a reduction is warranted, but the client insists an appeal should be filed, and you have a good reason to take on the appeal instead of simply declining the work. In this case, you need to be absolutely clear with the client that there is not much of an opportunity. And explain that their tax savings may not even cover your bill. It’s strange, but I’ve had this happen a few times.

- When a successful assessed value reduction won’t result in any tax savings. In Arizona, for example, homeowners’ taxes aren’t based on the full market value, so reductions won’t necessarily result in direct tax savings. But they still want to keep that value as low as possible since it can only increase by a certain percentage year-over-year. So clients might want to pay you a flat fee to keep this cap low.

You should probably get several appeals under your belt before deciding on a flat rate. You don’t want to undercut yourself or overcharge your clients.

Hourly

Hourly rates are a good alternative to flat fees for the same two scenarios we just mentioned. Just know that your client will want an estimate of hours upfront so they can budget for the full cost of the service. And they will not be happy if you go over that estimate.

5. Play the Long Game

To make money with property tax appeals, you need to be patient.

After you file the appeal, it can take a few months for the county to schedule your case. In busy counties like Los Angeles, 6-12 months isn’t uncommon. After presenting your case and negotiating a reduction, it can take an additional month or two for the county to correct its records and issue a lower tax bill (or a refund if the taxes were already paid).

So you could be investing lots of hours upfront and waiting over a year to see the payoff. But as a real estate agent, you’ve probably done that before, right?

How to Start

The quickest and easiest way to start is to pick up a copy of The Real Estate Agent’s Guide to Property Tax Appeals: How to Add a Revenue Stream to Your Business in Just 7 Days from my Etsy shop. This eBook will guide you through the process of researching your local taxing policies and setting up your new service in just seven days.

The quickest and easiest way to start is to pick up a copy of The Real Estate Agent’s Guide to Property Tax Appeals: How to Add a Revenue Stream to Your Business in Just 7 Days from my Etsy shop. This eBook will guide you through the process of researching your local taxing policies and setting up your new service in just seven days.

My book may be the best way to start, but it isn’t the only way.

You could begin by Googling your County Assessment Appeals Board. Look for information on the appeal process in your county, like:

- how do you file an appeal?

- when is the appeal filing deadline?

- is there a filing fee?

- what are the requirements for a property tax representative?

- what is the tax assessment date (the date the assessed value applies to – many jurisdictions use January 1 every year)?

Once you have a basic understanding of how things work in your area, you can start reviewing properties. Begin by listing the property addresses, parcel numbers, and property characteristics for your local clients in a spreadsheet. You may even be able to export this data into a spreadsheet directly from the MLS. Make sure you also have columns for the purchase date and purchase price. Then you can research the current assessed values. Most counties post them online via the County Assessor’s Website (or the County Treasurer’s Website in small counties).

Highlight the assessments that seem high to you on a per-square-foot basis. Then conduct a quick CMA to establish your opinion of value for those properties. Make sure you’re comparing sales around the tax assessment date, not necessarily the most recent sales.

For those that appear to be over-valued, contact the property owners and pitch your services. Explain why you feel you could reduce their property tax bill and ask for their business.

Feel free to use my property tax appeal pitch if you’d like. Just enter your info in the form below, and the link to the PDF will be delivered to your inbox.

Next Level

Once you’ve gotten a few appeal cases under your belt, you’ll know if you want to invest more time in this income stream.

If so, expand your property search. You can even purchase value data in bulk from your county to find new potential clients. An assistant could handle the admin work, leaving you to simply work up the values, negotiate with the county, and present your cases.

Get a Small Win

Great victories are the result of small wins. Before you move on with the rest of your day, get a small win!

If you’re interested in learning more about this income stream, pick up a copy of The Real Estate Agent’s Guide to Property Tax Appeals: How to Add a Revenue Stream to Your Business in Just 7 Days or google your county assessment appeals board today and find the information related to appealing your property taxes.

If this isn’t your thing, check out our list of 25+ Side Hustles for Real Estate Agents to find a better fit.

Thanks for explaining the process of property tax appeal, such as how it’s important for professionals to provide accurate numbers. If someone wants to hire a company for property tax services, it would probably be a good idea to research local companies by reading reviews and by talking to people who have used their services before. This would be useful to check their reputation to learn about their experience in order to figure out which one can provide quality help and accurate information.

Well worth a read. Got great insights and information from your blog. Thanks.

Thank you for the excellent article