This post was originally published on December 8, 2017. Here is the new and improved version.

5 Reasons Real Estate Agents Need Multiple Streams of Income

Multiple streams of income are great for everyone, but they’re especially important for real estate agents.

Real estate agents have unique financial circumstances, like dependency on the strength of the local housing market and irregular, commission-only paychecks, for example. The best way to compensate for these financial obstacles is to add multiple streams of income. But there are even more compelling reasons for real estate agents specifically to add multiple streams of income to their business practices. Let’s explore these reasons.

1. To whether a down housing market

What happened to real estate agents during the great recession?

Even if you weren’t in the industry at that time, you correctly deduced that the industry struggled as the housing market slowed. And agents suffered.

The real estate sales industry lost nearly 20% of its workforce during the last recession according to the US Bureau of Labor and Statistics.

We all hope that lessons were learned from the Great Recession and that we won’t hit that same kind of low again. But the fact is, markets are cyclical. Like a pendulum swinging back and forth, the housing market “corrects” itself every few years to avoid out-of-control increases.

Are you prepared for the next downturn?

If your only source of income is real estate sales, your business and your livelihood is at risk.

How Multiple Streams of Income Can Help

A down housing market is especially difficult to whether because it often goes hand-in-hand with the economy as a whole. When the real estate market is depressed, consumers are typically spending less money in general. So even if you have multiple income streams, you may struggle to find customers for those other streams as well.

But there is a largely untapped revenue stream that runs counter to the real estate cycle. When real estate sales are down, this revenue stream is up, and vice versa.

What is this recession-proof income stream?

It’s property tax appeals.

Now before you dismiss this as uninteresting (because really, who is interested in property taxes?), take just a second to consider what’s involved in property tax appeals and why you’re already perfect for it.

Here’s how property tax appeals work:

- Property taxes are based on the County Assessor’s estimated value of the property.

- County Assessors often incorrectly estimate value. This is especially true when the market drops because Assessors don’t want to lower everyone’s tax bills.

- If the homeowner (or their representative, i.e. you) can show the County that the property is actually worth less than their estimate, the County will correct the value in their records and reduce the taxes accordingly.

- Many homeowners don’t have real estate valuation knowledge or experience to confidently present their case for a change in value, and will gladly pay a professional to handle the appeal for them.

You’re perfect for this service-based income stream because you already have:

- local real estate market knowledge

- an existing client base of property owners and tenants

- an understanding of basic property valuation

- negotiation skills

- contract experience

- an entrepreneurial mindset

- an open schedule because of the decrease in home sales during a recession

All you need to learn is the specifics of how your county handles tax levies and appeals. That’s it.

I happen to have worked in property tax appeals for six years, so if you’re interested in learning more about this, check out my post, How to Make Money with Property Tax Appeals. Then reach out via Facebook, Twitter, email, or the comments section of this post if you still want more info. I’d be happy to help you get started.

PS: A down housing market is also a great time to own rental property. Rents can actually increase in a down market as homeownership looks less attractive and more people decide to rent. And with an increase in renters, there may also be more opportunity to sell your property management services.

2. To Smooth the Highs and Lows of Commission-Only Paychecks

Even if you’re not facing an immediate recession, being a commission-only professional poses serious cash flow challenges.

You may have a stellar month followed by a month or two (or three!) with zero income. That makes for a budgeting nightmare. How can you possibly be confident that you’ll have enough to cover all your future bills when your income is so uncertain?

Some agents have told me they actually see this as a benefit. The constant threat of not being able to pay the bills forces them to work harder and make sales happen. That’s a fair point.

But you wouldn’t turn down extra income from another source to force yourself to work harder, would you? And I hate to say it, but even the best agents go through slumps at some point or other, often due to circumstances out of their control.

How Multiple Streams of Income Can Help

Multiple streams of income smooth out the highs and lows of your commission-only pay structure by diversifying your income. They bring you money even if you hit a temporary slump in real estate sales.

Just imagine going to work every day knowing that you’ll be able to pay your bills this month whether you sell a house or not. You’ll be able to focus on helping your clients instead of putting food on the table (or in your car’s cup holder!).

For those who want to retain the thrill of living sale-to-sale, you can still benefit from a second income stream. Just make your extra money difficult to access. Lock it up in investments that will pay off big later. Think retirement accounts, rental properties, or dividend growth investments.

You don’t have to make the extra income stream available to spend, but you’ll increase your assets for future benefit and will have something to liquidate if that’s ever absolutely necessary.

3. To pay down debt and boost savings and investments

Let’s be real. Most real estate agents don’t make a lot of money. The median real estate agent’s annual salary is just $40,333 (as of September 2017 according to Salary.com). This is well under the median salary for the average American worker, which was $44,148 at the end of 2016 (according to the Bureau of Labor Statistics).

Add that to the fact that most of us have too much debt and too little savings, and we’re putting ourselves in a dangerous financial situation.

You may be able to make ends meet with $40,000/year. But how much does that leave for you to pay down debt and save?

You know you need to pay down your debts to avoid leaking money on interest payments every month. And you know you should be saving for retirement. But more than that! You may want to save to travel. Or launch your own brokerage one day. Maybe you’d like to be able to pay for your children’s college.

It’s really difficult to pay down debt, save, and invest on $40,000 per year.

How Multiple Streams of Income Can Help

So increase your income! If you can live on your real estate agent commissions, you can transfer your side-income directly to an aggressive debt payoff plan. Or to a life-changing saving or investment account.

4. To accumulate real wealth

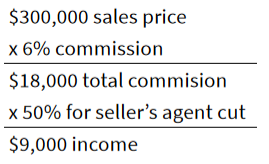

Most new agents come into the business expecting to make a living fairly easily. They consider the average home price and a standard 6% commission rate and think real estate sales income will be easy.

Here’s how Inexperienced Agents do the math:

Great; I’m making $9,000 on this one sale! I only need to make five sales per year to beat the average.

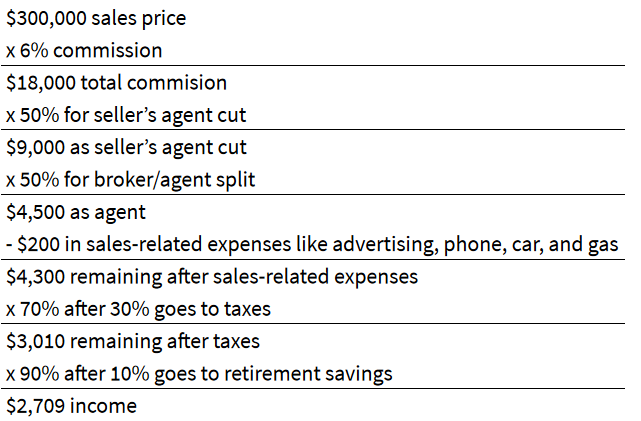

But here’s how Professional Agents do the math:

Suddenly you need to sell quite a few homes at $2,709 per deal to make a living.

With that kind of profit per deal, can the average agent accumulate real wealth?

How Multiple Streams of Income Can Help

Multiple streams of income make it a whole lot easier for average-income agents to build wealth. Especially when the side-income is invested in long-term assets that generate additional income and grow in value over time.

5. To build a business empire

Perhaps you entered the real estate industry more for the thrill of the business than for just the money. Maybe you’re looking to grow your personal brand, increase your reach into other markets, and leave a legacy for your children to take over someday.

How Multiple Streams of Income Can Help

Multiple streams of income don’t have to just be about the money. They can be about adding services to your real estate brokerage business to better serve your clients.

Many services can be used to provide more value to your buyers and sellers while simultaneously bringing you more buyers and sellers through a strong referral network.

Consider services like:

- Property Tax Appeals

- Home Staging

- Home Repairs and Maintenance

- Rental Property Management

- Landscape Design and Maintenance

- Painting, Cleaning, or Roofing

- Property Inspection or Appraisal

Or perhaps you can use products to service your clients and grow your brand:

- eBooks and/or courses to educate buyers, sellers, and investors

- Equipment Rentals to give your clients a better option than Home Depot for renting tools for DIY home repairs and upgrades

Any of these side-hustles would not only increase your income but would also help you build your business empire.

Get a Small Win

Great victories are made possible by small wins. Before you move on with the rest of your day, get a small win!

Your Small Win Challenge is to consider the different ways you could possibly add multiple streams of income to your real estate sales business. Check out my 25+ Ways to Make Money as a Real Estate Agent and just see if any of them appeal to you.

You can get an additional small win today by joining the Community! We publish great new content every week to help real estate professionals like you create and manage multiple income streams. Get inspired with new money-making ideas and get the details on putting these ideas into action.

Do you already have multiple streams of income? If so, our community would love to hear about it! Leave a comment to let us know what you’re doing and how it’s going.